Freeport-McMoRan: A Comprehensive Analysis of a Mining Giant's Evolution and Future

Critical Mining, Critical Moment: How Freeport-McMoRan Leads the Charge to Reduce U.S. Dependency on China

Macro Outlook:

Sit, kneel, bend, you degenerate gamblers. Freeport-McMoRan is an excellent example of the increase in critical and rare earth mining in the US as we shift away from Chinese dependency. However, China still does 90%+ of rare earth refinement, so there are still a lot of opportunities left in the sector to pivot away from Chinese dependency. FCX, in addition to Dr. Copper, is big on Molybdenum (geeked off that molly), which has a lot of uses in the aerospace and defense sectors. Primarily in steel alloys to increase strength, hardness, electrical conductivity, and resistance to corrosion and wear. Which will be crucial as the US revives its defense and manufacturing capabilities

Introduction: The Mining Giant at a Glance

Freeport-McMoRan (FCX) has emerged as one of the world's premier mining companies, with a market capitalization of $68.85 billion and a total enterprise value of $84.85 billion. As we delve into the company's story, we'll explore how FCX has positioned itself as a leader in the global mining industry through strategic acquisitions, operational excellence, and forward-thinking growth initiatives.

The Evolution of Modern Freeport

The Transformative Phelps Dodge Acquisition

The creation of "Modern Freeport" can be traced back to the watershed moment in 2007 when the company acquired Phelps Dodge. This strategic move fundamentally transformed FCX's asset base and operational capabilities, setting the stage for decades of growth and expansion. The acquisition brought high-quality copper assets into the portfolio and established FCX as a dominant force in the American mining landscape.

Legacy of Operational Excellence

One of the crown jewels in FCX's portfolio is the Morenci Mine in Arizona, which exemplifies the company's long-term operational success. This flagship asset is the largest U.S. mine with over a century of operational history. It is projected to continue operations for another hundred years, demonstrating FCX's ability to manage and sustain long-term mining operations.

Competitive Position: A Deep Dive into Market Leadership

Market Position and Valuation

Freeport-McMoRan's market capitalization of $68.85 billion places it among the elite tier of global mining companies, though it sits slightly behind Southern Copper Corporation's $89.42 billion market cap. This valuation reflects the market's strong confidence in FCX's operational capabilities and growth potential. The company's total enterprise value of $84.85 billion, including equity and debt, demonstrates the substantial scale of its operations and provides it with significant leverage in the industry.

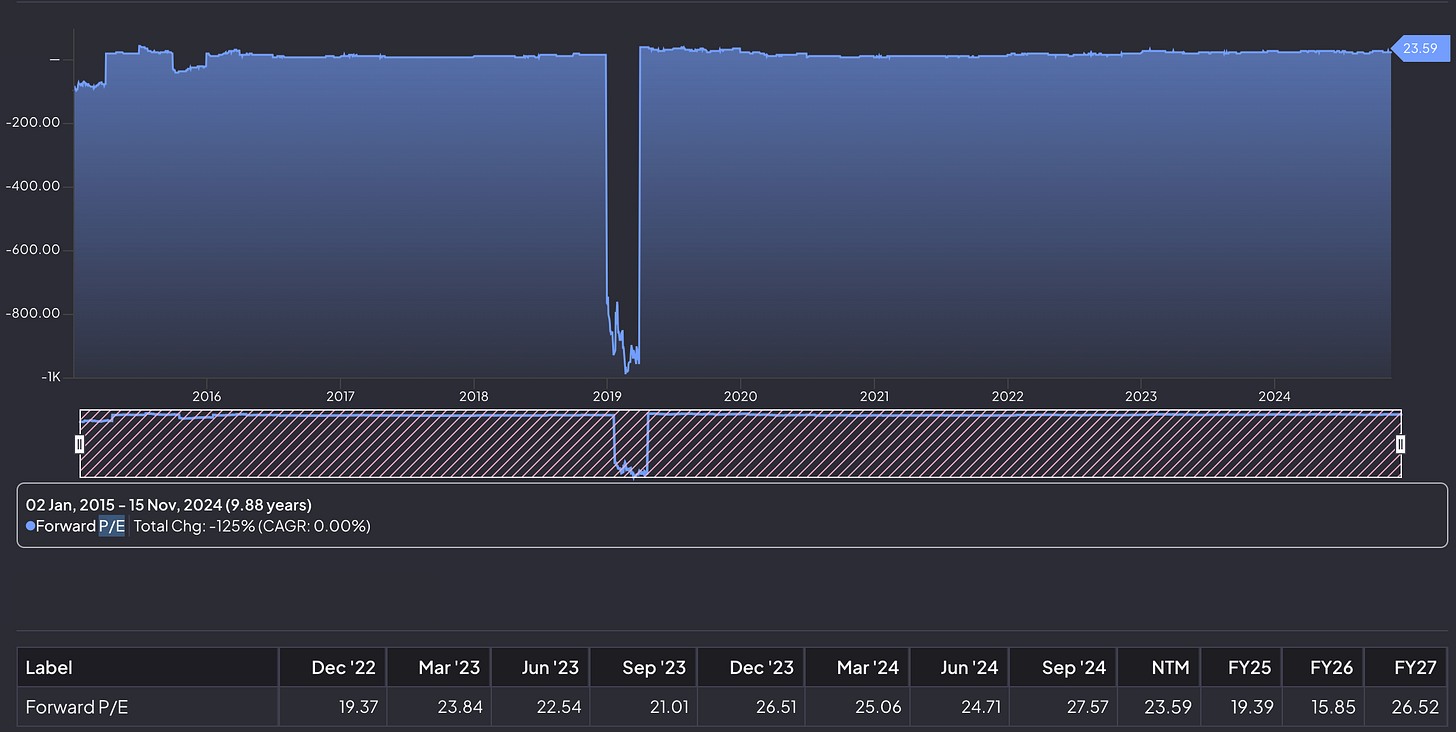

The company's forward P/E ratio of 27.18 stands notably higher than most of its peers in the mining sector. This premium valuation suggests that investors are willing to pay more for FCX's earnings potential than competitors. For context, Southern Copper trades at a forward P/E of 23.44, while Newmont Corporation's ratio stands at 14.19. This higher multiple reflects FCX's management team's market expectations of superior growth and execution.

Regarding enterprise value to sales (EV/Sales) metrics, FCX maintains a moderate ratio of 2.98x. This positions the company favorably against Southern Copper's higher multiple of 7.53x, suggesting FCX might offer better value relative to its revenue generation. However, it trades at a premium compared to more diversified miners like Nucor Corporation (1.21x) and Steel Dynamics (1.25x), indicating the market's preference for FCX's focus on copper and precious metals.

Growth Trajectory Analysis

The company's revenue growth tells a compelling story of consistent expansion. The three-year compound annual growth rate (CAGR) of 6.58% demonstrates steady progress, particularly impressive compared to Southern Copper's more modest 1.52% growth over the same period. This outperformance becomes even more striking when examining the five-year CAGR of 12.58%, significantly outpacing Southern Copper's 8.96% growth rate.

The earnings picture presents a more complex narrative. While the three-year earnings per share (EPS) CAGR shows a decline of 19.46%, this should be contextualized within broader industry challenges and commodity price cycles. More tellingly, the five-year EPS CAGR of 54% reveals FCX's ability to generate substantial shareholder value over extended periods. This dramatic improvement over the longer term demonstrates management's ability to navigate commodity cycles and execute on operational improvements.

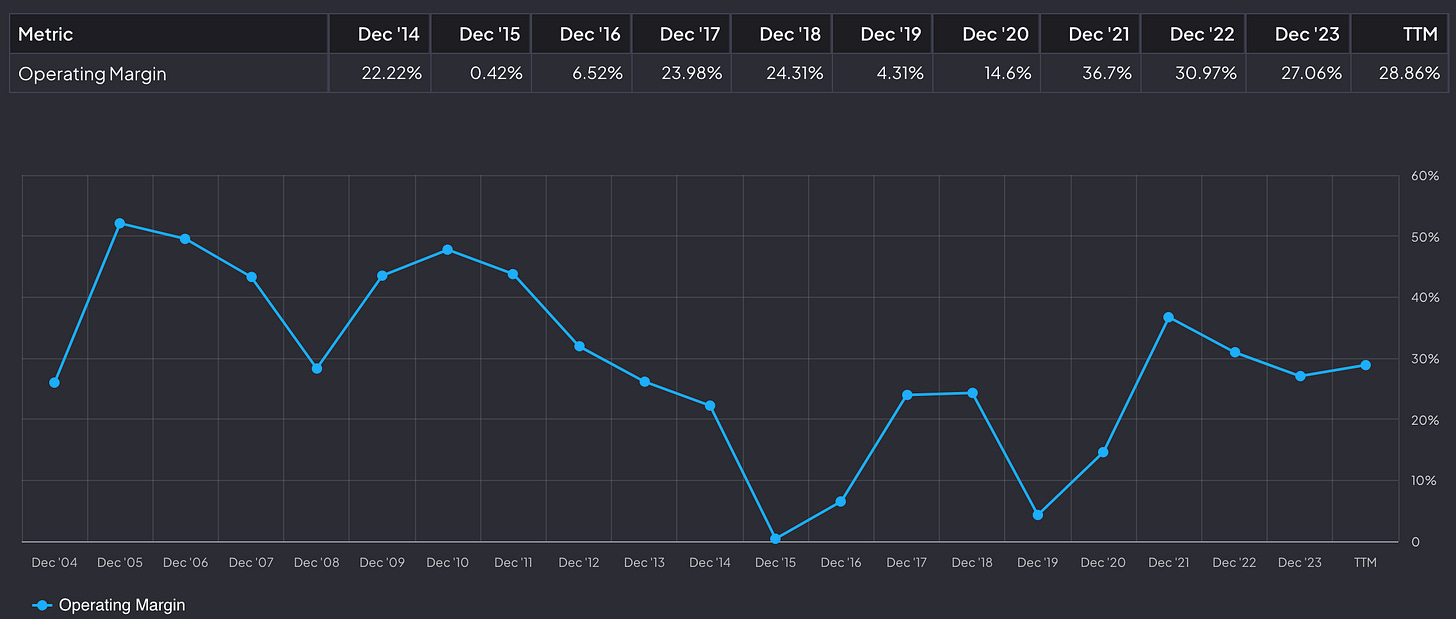

Operational Efficiency and Margin Analysis

FCX's TTM operating margin of 28% stands as a testament to its operational excellence and cost management capabilities. While this falls below Southern Copper's industry-leading 46.74% margin and Royal Gold's 53.17%, it significantly outperforms many significant players in the metals and mining space. For perspective, this margin is:

Nearly triple Alcoa Corporation's 3.74% operating margin

More than double Nucor Corporation's 11.58%

Substantially higher than Steel Dynamics' 12.42%

Well above United States Steel Corporation's 3.28%

This strong margin performance indicates FCX's success in:

Maintaining cost discipline across its operations

Effectively leveraging its scale for operational efficiency

Successfully managing its portfolio of assets

Implementing advanced technologies and processes to improve productivity

Financial Performance Deep Dive

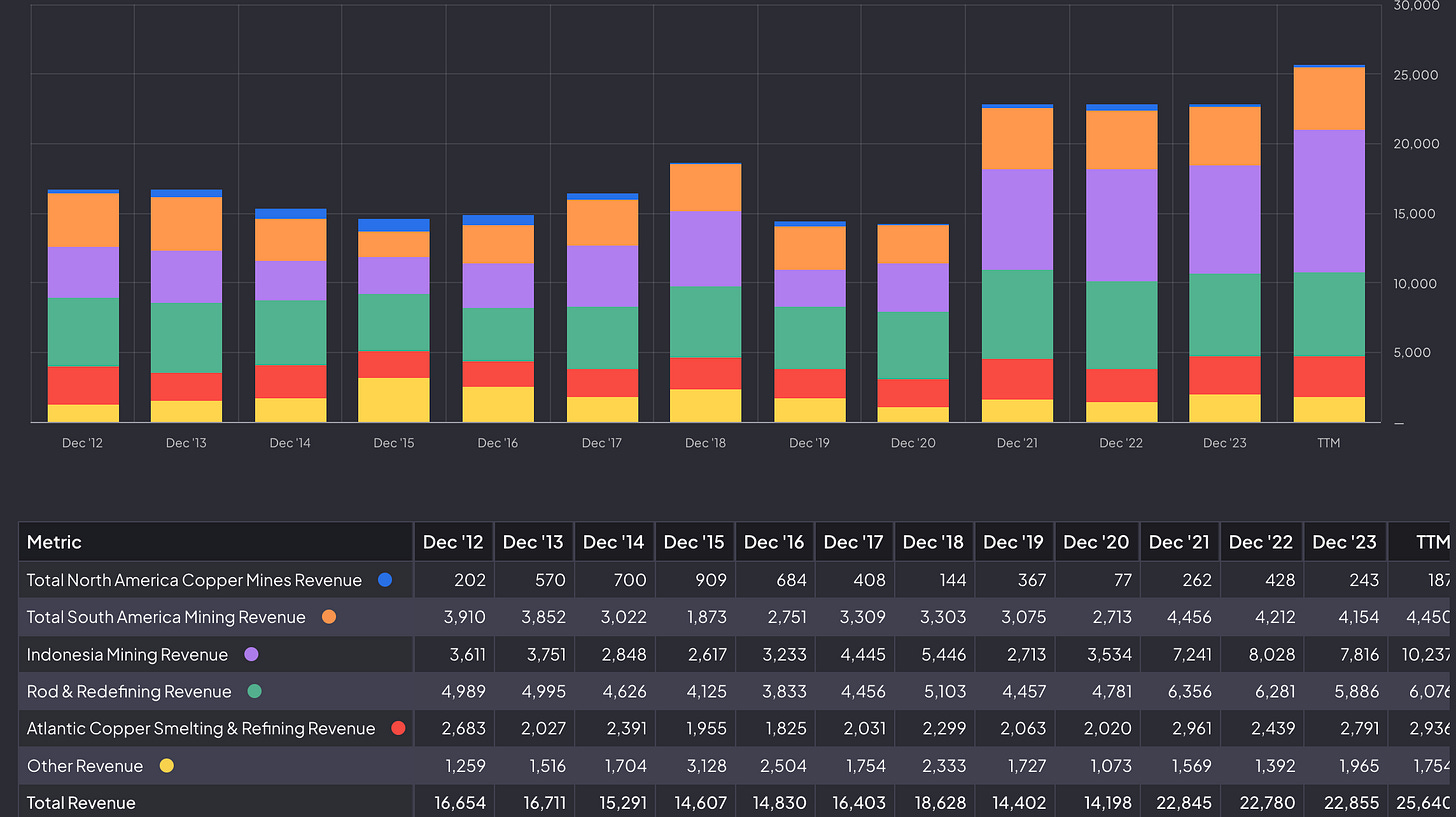

Revenue Analysis and Trends

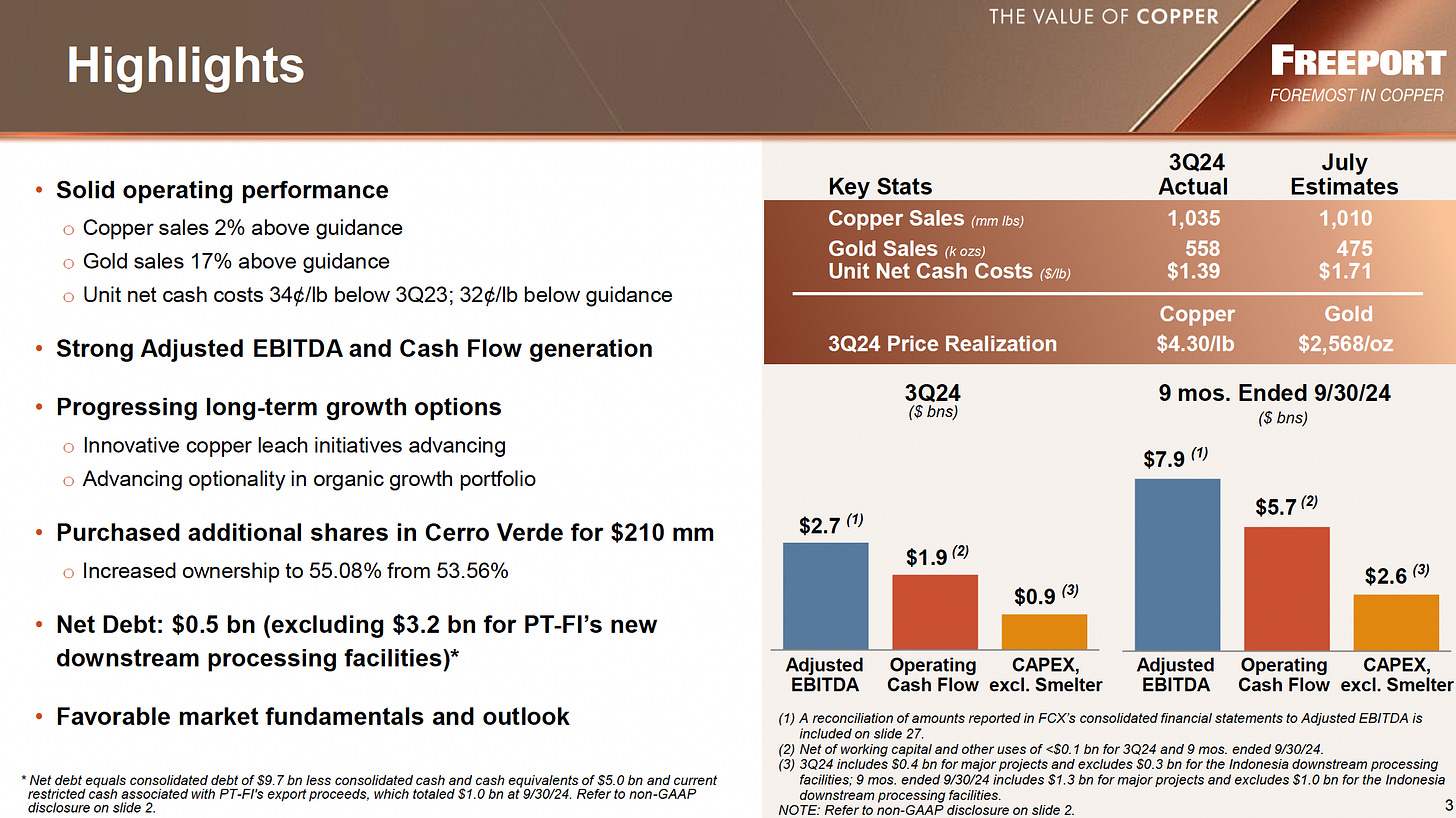

Freeport-McMoRan's revenue performance shows a clear pattern of growth and resilience. The 2023 annual revenue of $22.86 billion set a strong baseline, but the real story emerges in the subsequent quarters. The Last Twelve Months (LTM) revenue as of Q3 2024 reached $25.64 billion, representing a substantial 12.2% increase from the annual 2023 figure. This growth demonstrates the company's ability to capitalize on favorable market conditions and execute its operational strategy effectively.

The quarterly revenue of $6.79 billion in Q3 2024 stands out, representing an annualized run rate of $27.16 billion. This suggests continued momentum in the company's core operations, which is especially impressive considering the cyclical nature of the mining industry and various global economic challenges.

Capital Investment Strategy

FCX's capital expenditure (CapEx) trajectory reveals a company aggressively investing in its future while maintaining financial discipline. The 2023 annual CapEx of $4.824 billion, representing a 39.06% year-over-year increase, demonstrates the company's commitment to growth and operational improvement. This significant investment continued into 2024, with LTM CapEx reaching $5.128 billion, a further 13.23% increase.

The quarterly CapEx figure of $1.409 billion in Q3 2024 shows sustained investment momentum, indicating that FCX is:

Actively pursuing its growth projects across multiple sites

Upgrading existing infrastructure to improve efficiency

Investing in technological improvements to enhance productivity

Maintaining its asset base to ensure long-term operational stability

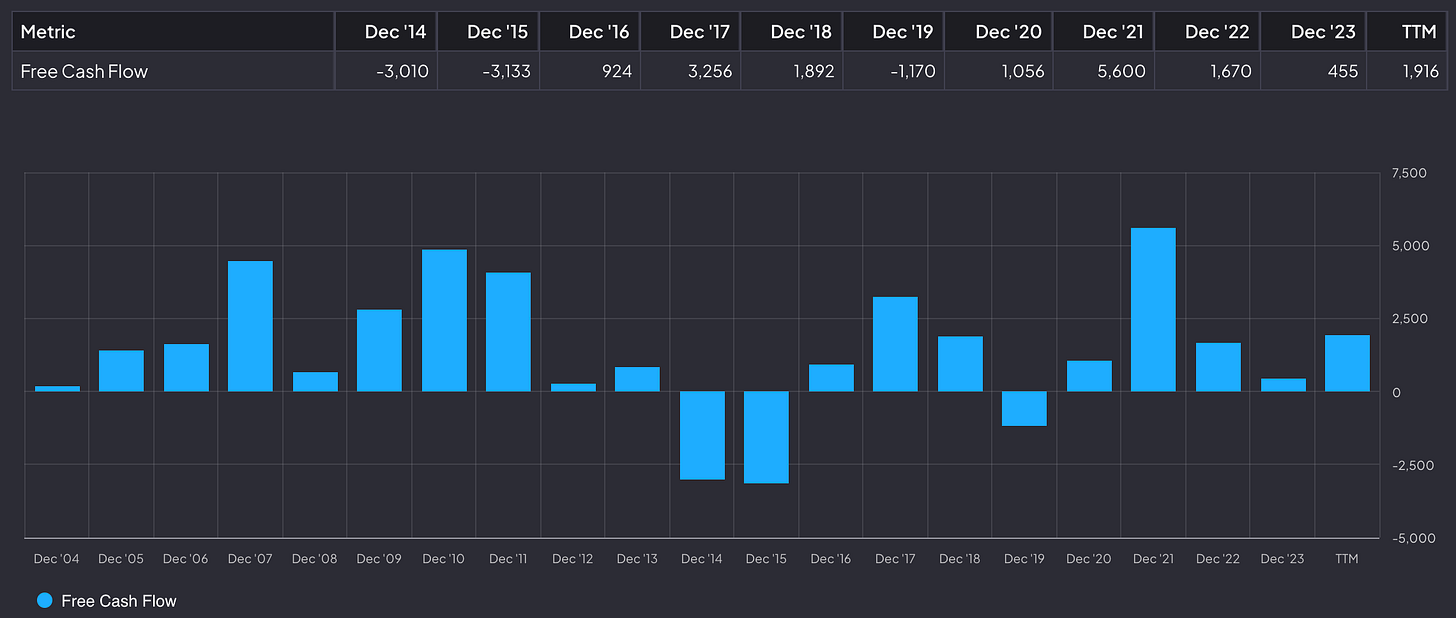

Cash Flow Generation and Financial Flexibility

We all know FCF is the king of financials (ask the OG Aswath Damodaran). The company's free cash flow performance has been particularly impressive, showing dramatic improvement over recent periods. The LTM free cash flow of $1.916 billion as of Q3 2024 represents a remarkable 283.97% growth, demonstrating FCX's ability to convert its operational success into tangible financial returns. This substantial increase from the 2023 annual free cash flow of $455 million highlights:

Improved operational efficiency, driving stronger cash generation

Successful cost management initiatives

Effective working capital management

Benefits of previous capital investments beginning to materialize

The quarterly free cash flow of $463 million in Q3 2024, representing a 698.28% growth, further underscores the company's strong execution and improved cash generation capabilities. This robust cash flow position provides FCX with significant financial flexibility to:

Fund its ambitious growth projects

Maintain competitive shareholder returns

Manage debt levels effectively

Respond to market opportunities as they arise

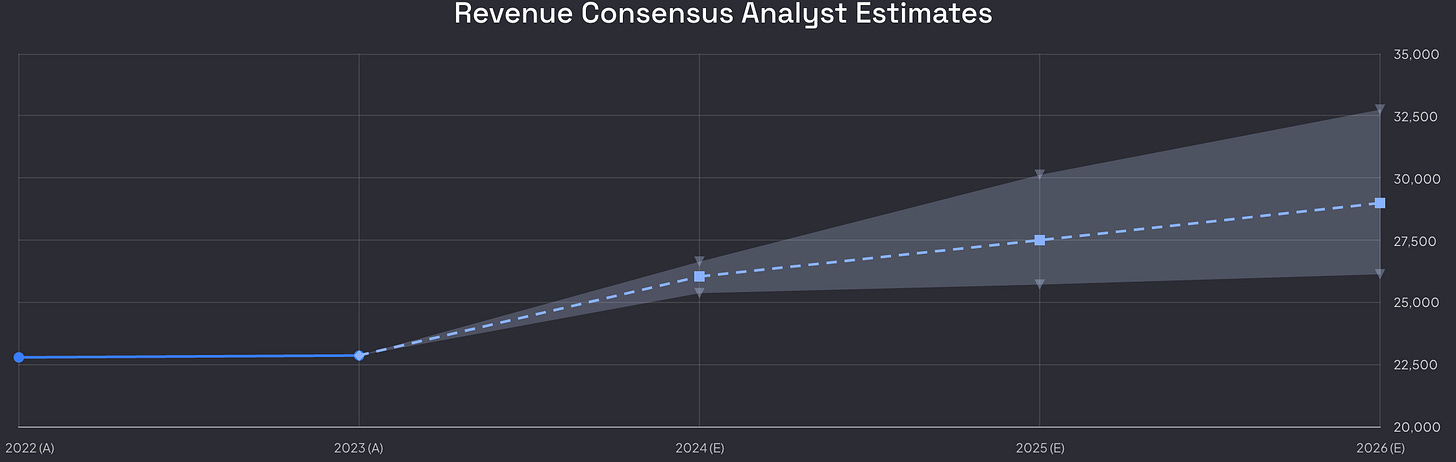

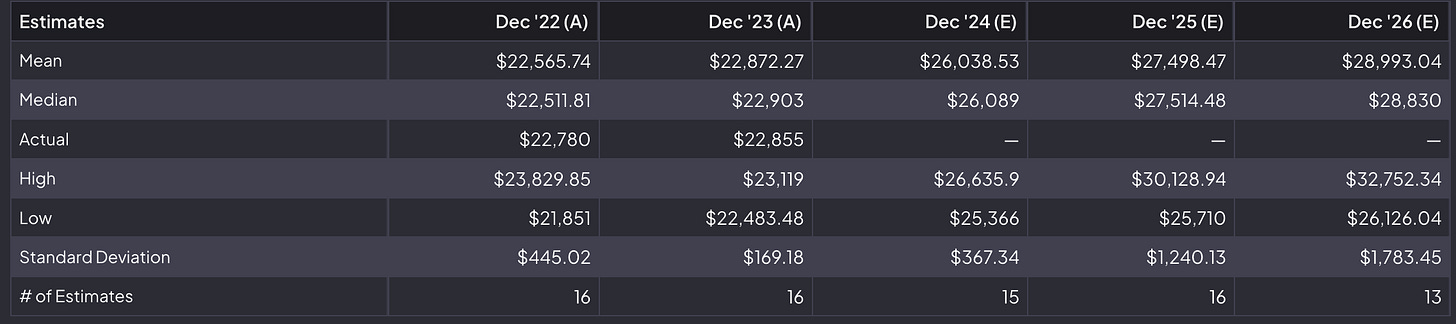

Future Revenue Projections: A Detailed Analysis

Annual Growth Trajectory

The analyst community's revenue projections for Freeport-McMoRan suggest steady, sustainable growth over the next several years. The 2024 revenue estimate of $26.04 billion, based on 15 different analyst projections, represents a significant step up from 2023's $22.86 billion, suggesting an expected year-over-year growth of approximately 13.9%. This forecast is particularly credible given the breadth of analyst coverage and aligns with the company's expanding production capabilities.

Moving into 2025, analysts project revenues of $27.5 billion based on 16 estimates. This forecasted increase of $1.46 billion (5.6% growth) from 2024 reflects expectations of:

Continued ramp-up of expansion projects

Stable commodity price environments

Successful execution of operational improvements

Increased production from brownfield expansions

The 2026 projection of $28.99 billion, while supported by fewer analysts (13 estimates), suggests continued momentum in FCX's growth trajectory. This represents a further 5.4% increase from 2025, indicating analyst confidence in FCX's ability to:

Successfully complete and integrate major growth projects

Maintain operational efficiency at scale

Navigate market conditions effectively

Capitalize on increasing global demand for copper

Quarterly Progress and Momentum

The quarterly revenue projections provide a more granular view of FCX's expected growth pattern:

Q4 2024's projected revenue of $6.14 billion (based on 3 estimates) sets a solid baseline, but the real story emerges in the sequential quarterly progression through 2025:

Q1 2025: $7.03 billion (2 estimates)

Q2 2025: $7.60 billion (2 estimates)

Q3 2025: $7.69 billion (2 estimates)

Q4 2025: $7.61 billion (1 estimate)

This quarterly progression shows an expected step-change in revenue generation, with each quarter in 2025 showing substantial improvement over Q4 2024. The sequential growth from $7.03 billion in Q1 to $7.69 billion in Q3 2025 represents a 9.4% intra-year improvement, suggesting analysts expect FCX's growth initiatives to begin bearing fruit during this period.

Looking further ahead, the quarterly estimates for 2026 continue the positive momentum:

Q1 2026: $7.69 billion

Q2 2026: $7.77 billion

Q3 2026: $7.85 billion

This steady quarter-over-quarter growth pattern indicates expectations of consistent operational execution and successful project delivery.

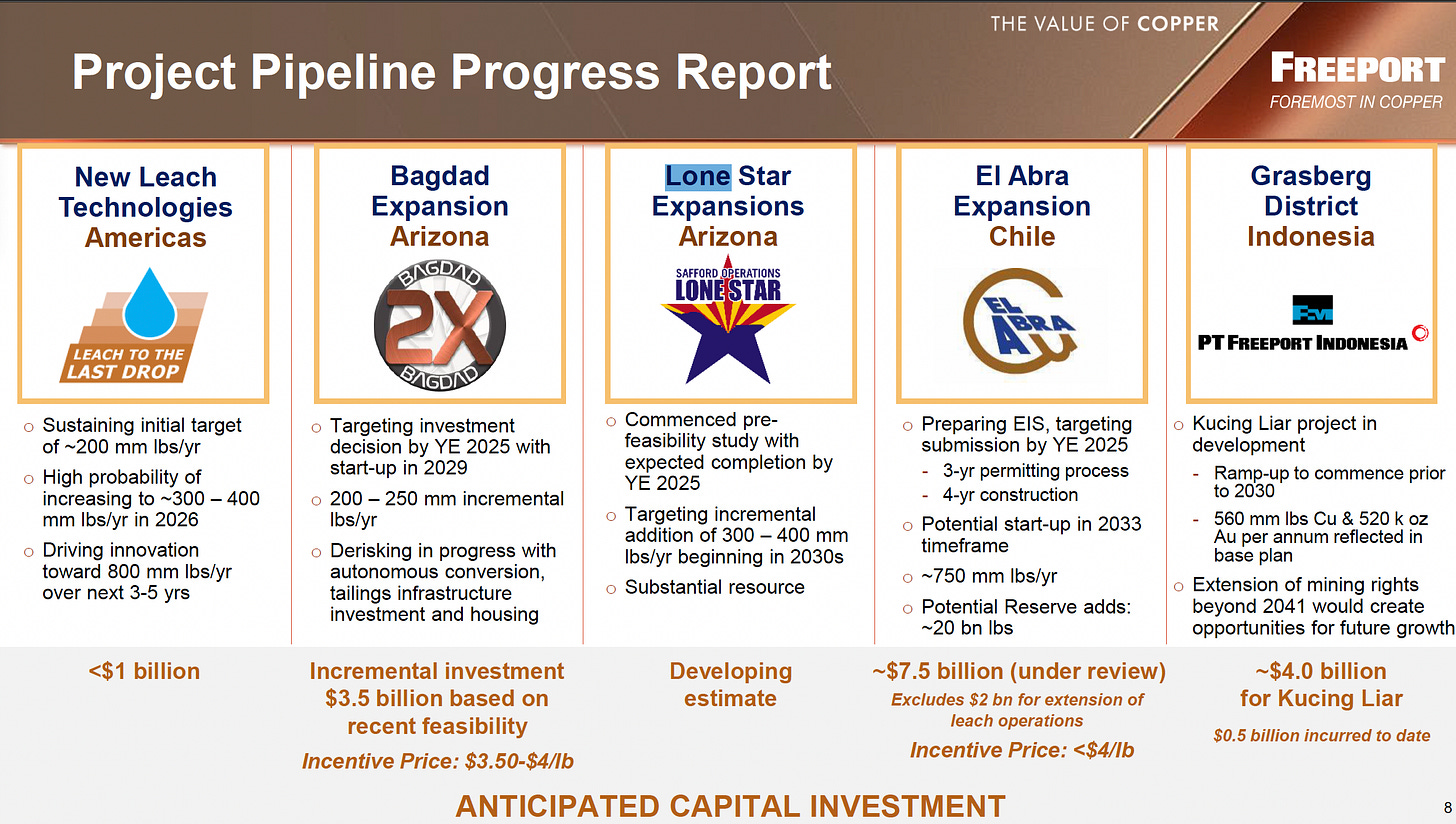

Growth Strategy: Comprehensive Project Analysis

The Safford Lone Star District Expansion: A Transformative Initiative

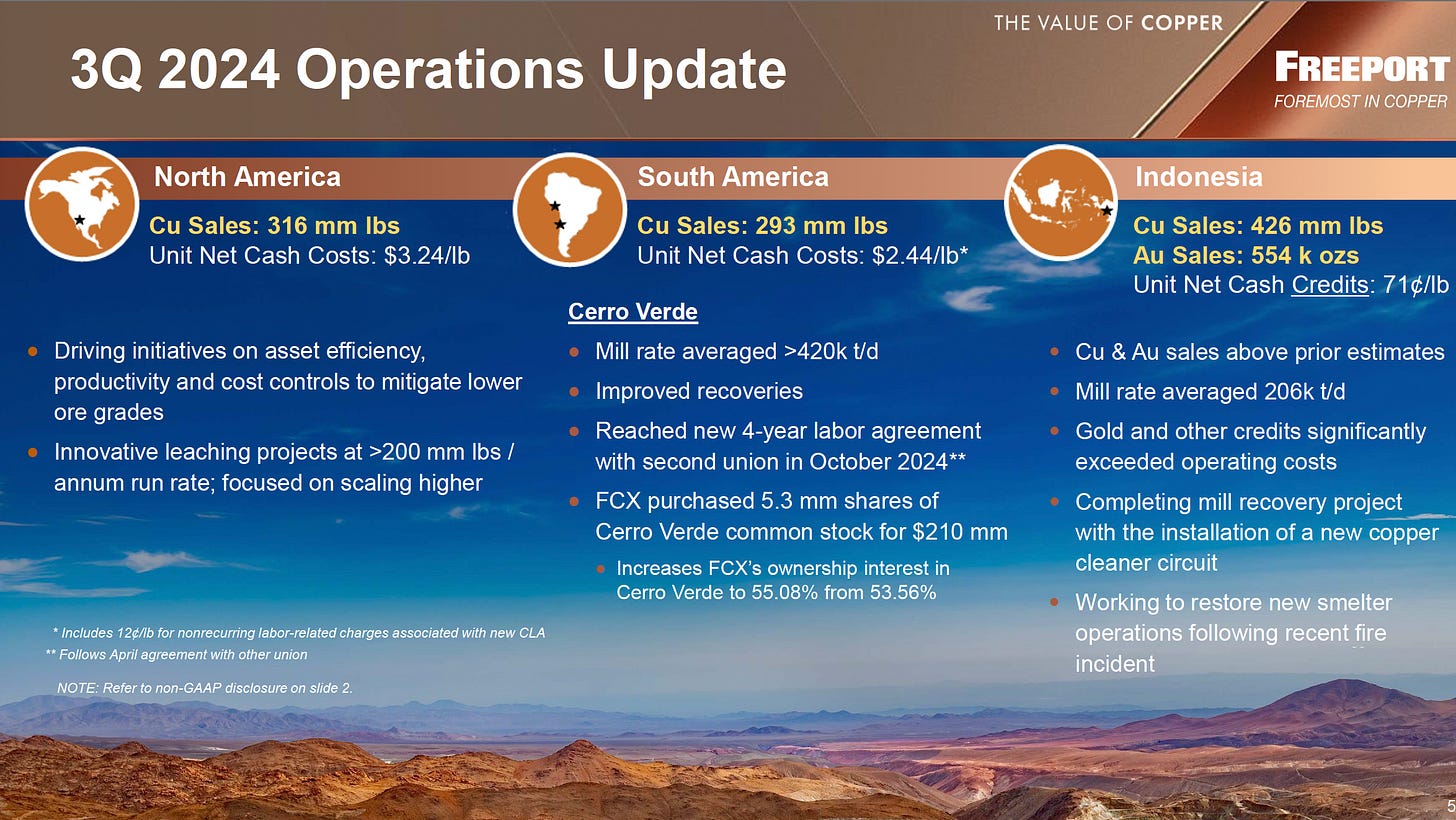

The Safford Lone Star District expansion represents FCX's most ambitious and strategically significant growth project. The current production baseline of 300 million pounds per annum serves as a foundation for what the company envisions as a transformative expansion. The project's importance can be understood through several key dimensions:

Strategic Value

Production Impact

Current State: 300 million pounds annual production

Future State: More than double current output

Long-term Potential: Positioning as a cornerstone asset

Regional Economic Impact

Job Creation: Significant employment opportunities

Infrastructure Development: Enhanced mining capabilities

Economic Multiplier: Broader economic benefits for Arizona

Operational Excellence

Technology Integration: Modern mining methods

Efficiency Improvements: Enhanced recovery rates

Environmental Considerations: Sustainable mining practices

The Leach Initiative: Innovative Value Creation

FCX's leach initiative demonstrates the company's commitment to innovative solutions for value creation. The progression from current production of 200 million pounds per year to the ambitious target of 800 million pounds represents a four-fold increase in production capacity. This initiative is particularly noteworthy for its:

Phased Implementation

Initial Phase (Current to 2026)

Starting Point: 200 million pounds annual production

Mid-term Target: 300-400 million pounds by 2026

Key Focus: Operational optimization and technology deployment

Long-term Vision

Ultimate Goal: 800 million pounds annual production

Implementation Strategy: Systematic capacity expansion

Technology Integration: Advanced leaching techniques

Operational Benefits

Cost Efficiency

Lower production costs through improved technology

Reduced energy consumption

Optimized resource utilization

Environmental Impact

Minimized environmental footprint

Reduced waste generation

Improved water management

Brownfield Expansion Portfolio

Bagdad Project Evolution

The Bagdad expansion represents a strategic investment in modernizing and expanding existing operations:

Timeline and Implementation

Project Duration: 3-4 years

Key Milestones: Phased implementation

Operational Continuity: Maintained during expansion

Technological Advancement

Fleet Automation: Converting to autonomous haulage

Process Optimization: Enhanced recovery methods

Digital Integration: Advanced monitoring systems

El Abra Strategic Development

The El Abra project stands as a comprehensive development initiative:

Production Targets

Copper: 750 million pounds annually

Molybdenum: 9 million pounds annually

Timeline: 7-8 years for full implementation

Infrastructure Development

New Concentrator: State-of-the-art processing facility

Support Systems: Enhanced logistics and handling

Environmental Controls: Advanced sustainability measures

Indonesian Operations Enhancement

The Kucing Liar development project represents FCX's commitment to long-term growth in Indonesia:

Strategic Timeline

Production Commencement: 2030 target

Operational Integration: Synergies with existing assets

Life Extension: Operations beyond 2041

Development Approach

Phased Implementation: Systematic development

Infrastructure Integration: Leveraging existing facilities

Community Engagement: Sustainable development practices

Challenges and Risk Management

Market-Related Challenges

Commodity Price Volatility

Copper prices significantly influence Freeport-McMoRan's revenue and project viability. The company manages this through strategic hedging and maintaining operational flexibility. In 2023-2024, the company demonstrated resilience with revenue growth despite price fluctuations, as evidenced by the increase from $22.86 billion in 2023 to an LTM revenue of $25.64 billion in Q3 2024.

Global Economic Conditions

The company's performance is tied to global industrial production and infrastructure development. The growth in free cash flow to $1.916 billion (LTM Q3 2024) shows FCX's ability to navigate economic cycles effectively. Key demand drivers include:

Industrial production levels

Construction sector activity

Electric vehicle and renewable energy adoption

Infrastructure development programs

Operational Challenges

Capital Requirements

Major projects require substantial investment, as demonstrated by FCX's increasing CapEx:

2023 Annual CapEx: $4.824 billion (39.06% growth)

LTM Q3 2024 CapEx: $5.128 billion (13.23% growth)

These investments, while significant, are strategically allocated across key growth projects like the Safford Lone Star expansion and the Leach Initiative, with clear production targets and ROI expectations.

Technical and Operational Risks

FCX manages these through:

Advanced mining technology implementation

Robust maintenance programs

Comprehensive geological assessment

Strong safety and training programs

Regulatory and Environmental Considerations

The company faces complex permitting requirements and environmental standards, particularly for projects like El Abra's expansion and Indonesian operations. FCX addresses these through:

Proactive environmental management

Community engagement programs

Comprehensive compliance systems

Sustainable mining practices

Investment Considerations

Competitive Strengths

Market Leadership

Second-largest market cap ($68.85B) in peer group

Strong operating margin of 28.47%

Superior revenue growth (5Y CAGR of 12.58%)

Operational Excellence

Proven execution capabilities across global operations

Successful track record of project delivery

Cost-efficient production methods

Technical innovation leadership

Growth Catalysts

Near-Term Growth Projects

Safford Lone Star expansion (doubling current production)

Leach Initiative (targeting 800M pounds annual production)

Brownfield expansions at multiple sites

Financial Momentum

Projected revenue growth to $28.99B by 2026

Strong free cash flow generation

Robust capital investment program

Risk-Adjusted Investment Thesis

The investment case for FCX is supported by:

Operational Strength

Geographic diversification

Technical expertise

Cost competitiveness

Strong asset base

Financial Health

Growing free cash flow

Disciplined capital allocation

Strong balance sheet

Operational efficiency

Market Positioning

Leading copper producer

Growing market share

Strategic asset portfolio

Strong customer relationships

Conclusion

Freeport-McMoRan presents a compelling investment opportunity based on:

Clear growth strategy with defined projects and timelines

Strong operational execution capabilities

Robust financial performance and metrics

Market leadership in copper production

Effective risk management practices

While challenges exist regarding commodity price exposure and capital requirements, FCX's track record of execution and strong market position support its premium valuation. The company's strategic growth initiatives, notably the Safford Lone Star expansion, and Leach Initiative position it well for long-term value creation in an industry crucial to global industrial and technological development.