CIPS overtaking SWIFT

China has been maneuvering for this for a decade

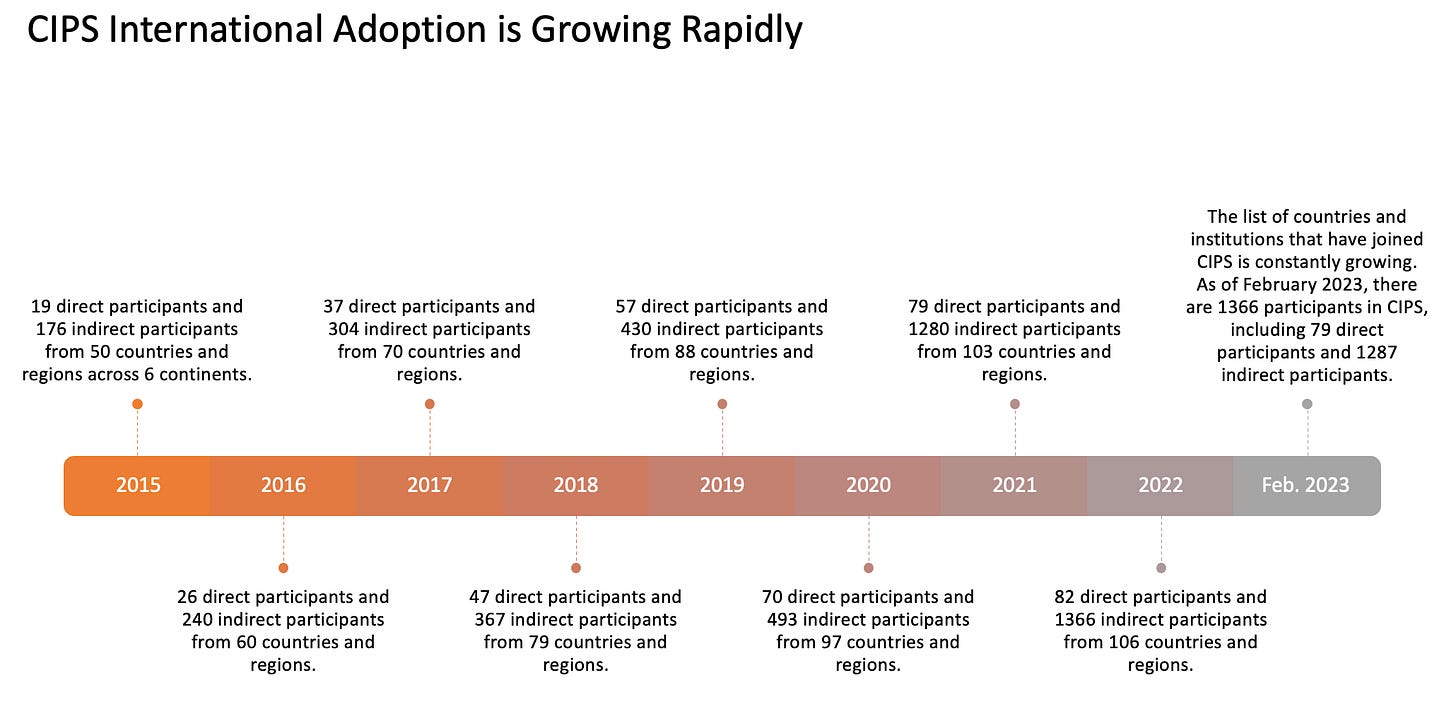

In recent years, China has been working to develop its cross-border payment system, the Cross-Border Interbank Payment System (CIPS). The CIPS is a real-time gross settlement system (RTGS) that allows banks to transfer funds between each other in the Chinese yuan. The system was launched in 2015 and has since grown rapidly. In 2021, the CIPS processed over 10 trillion yuan in transactions, up from just over 2 trillion yuan in 2017.

The CIPS is seen as a challenge to the dominance of the Society for Worldwide Interbank Financial Telecommunication (SWIFT) system. SWIFT is a Belgian-based cooperative that provides a messaging system that allows banks to communicate with each other and transfer funds across borders. Over 11,000 financial institutions use SWIFT in over 200 countries and territories.

Cips was unveiled in November 2015. While initial adoption rates were low due to the reliance on the SWIFT network, there was conveniently a series of significant cyberattacks targeting SWIFT starting in February of 2016. Those attacks were linked back to the CCP proxy state of North Korea and were designed to show weakness in the SWIFT network to speed up international adoption

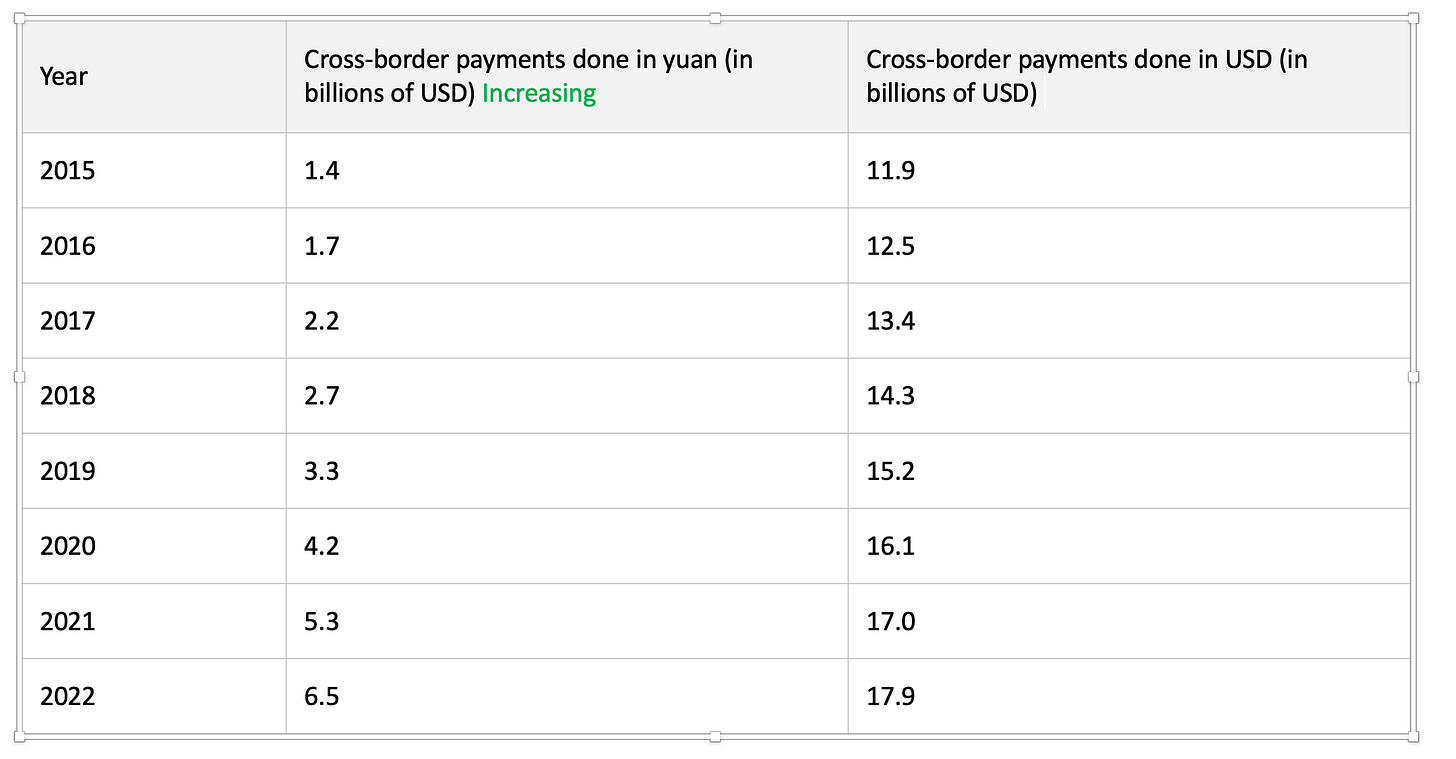

There are several reasons why China is developing the CIPS. First, China is fast reducing its reliance on the US dollar. The US dollar is the world's reserve currency in most international transactions. However, China has actively been working to undermine and beat the US on several issues, including trade and technology. China wants to reduce its reliance on the US dollar to be less vulnerable to US sanctions.

Second, the CIPS will allow China to promote the use of the yuan in international trade. The yuan is not as widely used as the US dollar, but China is trying to encourage its use. The CIPS will make it easier for banks to use the yuan in international transactions. We have recently seen France settling oil transactions in yuan and Brazil agreeing to drop the USD to settle transactions.

Third, the CIPS will help China to monitor cross-border financial flows. The Chinese government constantly worries about money flowing outside the Chinese mainland without the party's approval. The CIPS will give China more control over cross-border financial flows and help it add to the global surveillance program.

The CIPS is challenging the dominance of SWIFT. The CIPS is proliferating and being used by more banks. If the CIPS continues to grow, it will significantly impact the global financial system. However, the CIPS also faces some challenges. One challenge is that it is not yet as widely used as SWIFT. Over 11,000 financial institutions use SWIFT in over 200 countries and territories, while a few thousand use CIPS in 106 countries.

Despite these challenges, the CIPS is a significant development that could significantly impact the global financial system. as the CCP continues to gain global dominance, they will use economic weapons such as CIPS and the BRI to make the world more reliant on them.

So nice I have to say it twice

Yooooooooo